遞迴最小平方法¶

遞迴最小平方法是普通最小平方法的一個擴展視窗版本。除了可以遞迴計算迴歸係數外,遞迴計算的殘差還可被用來建構統計量,以研究參數不穩定性。

RecursiveLS 類別允許計算遞迴殘差,並計算 CUSUM 和 CUSUM 平方統計量。將這些統計量與表示統計上顯著偏離參數穩定零假設的參考線一起繪製,可以輕鬆地視覺指示參數穩定性。

最後,RecursiveLS 模型允許對參數向量施加線性限制,並且可以使用公式介面構建。

[1]:

%matplotlib inline

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import statsmodels.api as sm

from pandas_datareader.data import DataReader

np.set_printoptions(suppress=True)

範例 1:銅¶

首先,我們考慮銅數據集中參數的穩定性(描述如下)。

[2]:

print(sm.datasets.copper.DESCRLONG)

dta = sm.datasets.copper.load_pandas().data

dta.index = pd.date_range("1951-01-01", "1975-01-01", freq="YS")

endog = dta["WORLDCONSUMPTION"]

# To the regressors in the dataset, we add a column of ones for an intercept

exog = sm.add_constant(

dta[["COPPERPRICE", "INCOMEINDEX", "ALUMPRICE", "INVENTORYINDEX"]]

)

This data describes the world copper market from 1951 through 1975. In an

example, in Gill, the outcome variable (of a 2 stage estimation) is the world

consumption of copper for the 25 years. The explanatory variables are the

world consumption of copper in 1000 metric tons, the constant dollar adjusted

price of copper, the price of a substitute, aluminum, an index of real per

capita income base 1970, an annual measure of manufacturer inventory change,

and a time trend.

首先,構建並擬合模型,並列印摘要。儘管 RLS 模型會遞迴計算迴歸參數,因此估計值數量與資料點數量一樣多,但摘要表僅呈現根據整個樣本估計的迴歸參數;除了遞迴初始化的微小影響外,這些估計值與 OLS 估計值等效。

[3]:

mod = sm.RecursiveLS(endog, exog)

res = mod.fit()

print(res.summary())

Statespace Model Results

==============================================================================

Dep. Variable: WORLDCONSUMPTION No. Observations: 25

Model: RecursiveLS Log Likelihood -154.720

Date: Thu, 03 Oct 2024 R-squared: 0.965

Time: 15:46:06 AIC 319.441

Sample: 01-01-1951 BIC 325.535

- 01-01-1975 HQIC 321.131

Covariance Type: nonrobust Scale 117717.127

==================================================================================

coef std err z P>|z| [0.025 0.975]

----------------------------------------------------------------------------------

const -6562.3719 2378.939 -2.759 0.006 -1.12e+04 -1899.737

COPPERPRICE -13.8132 15.041 -0.918 0.358 -43.292 15.666

INCOMEINDEX 1.21e+04 763.401 15.853 0.000 1.06e+04 1.36e+04

ALUMPRICE 70.4146 32.678 2.155 0.031 6.367 134.462

INVENTORYINDEX 311.7330 2130.084 0.146 0.884 -3863.155 4486.621

===================================================================================

Ljung-Box (L1) (Q): 2.17 Jarque-Bera (JB): 1.70

Prob(Q): 0.14 Prob(JB): 0.43

Heteroskedasticity (H): 3.38 Skew: -0.67

Prob(H) (two-sided): 0.13 Kurtosis: 2.53

===================================================================================

Warnings:

[1] Parameters and covariance matrix estimates are RLS estimates conditional on the entire sample.

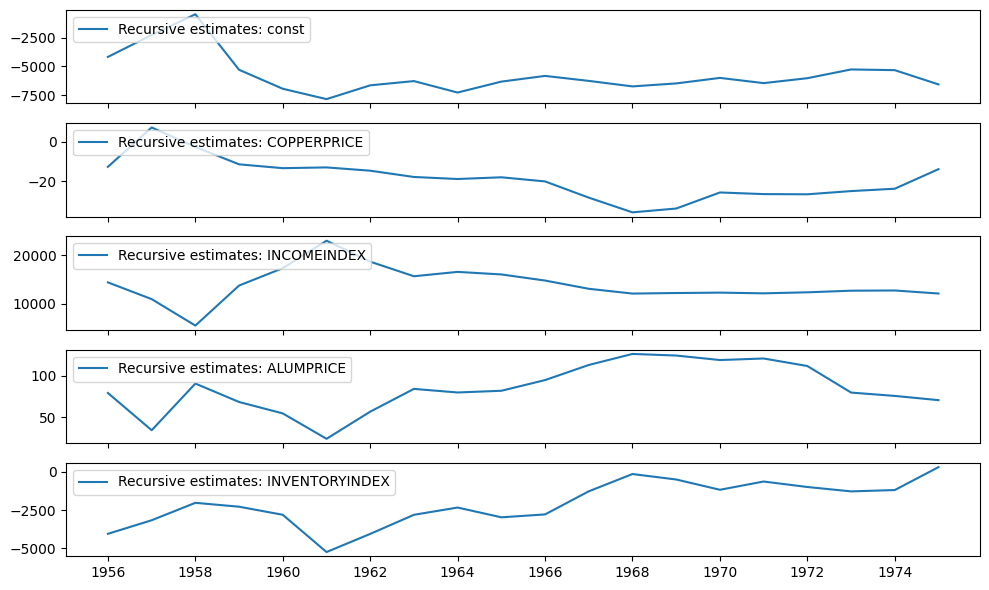

遞迴係數可在 recursive_coefficients 屬性中取得。或者,可以使用 plot_recursive_coefficient 方法生成繪圖。

[4]:

print(res.recursive_coefficients.filtered[0])

res.plot_recursive_coefficient(range(mod.k_exog), alpha=None, figsize=(10, 6))

[ 2.88890087 4.94795049 1558.41803044 1958.43326658

-51474.9578655 -4168.94974192 -2252.61351128 -446.55908507

-5288.39794736 -6942.31935786 -7846.0890355 -6643.15121393

-6274.11015558 -7272.01696292 -6319.02648554 -5822.23929148

-6256.30902754 -6737.4044603 -6477.42841448 -5995.90746904

-6450.80677813 -6022.92166487 -5258.35152753 -5320.89136363

-6562.37193573]

[4]:

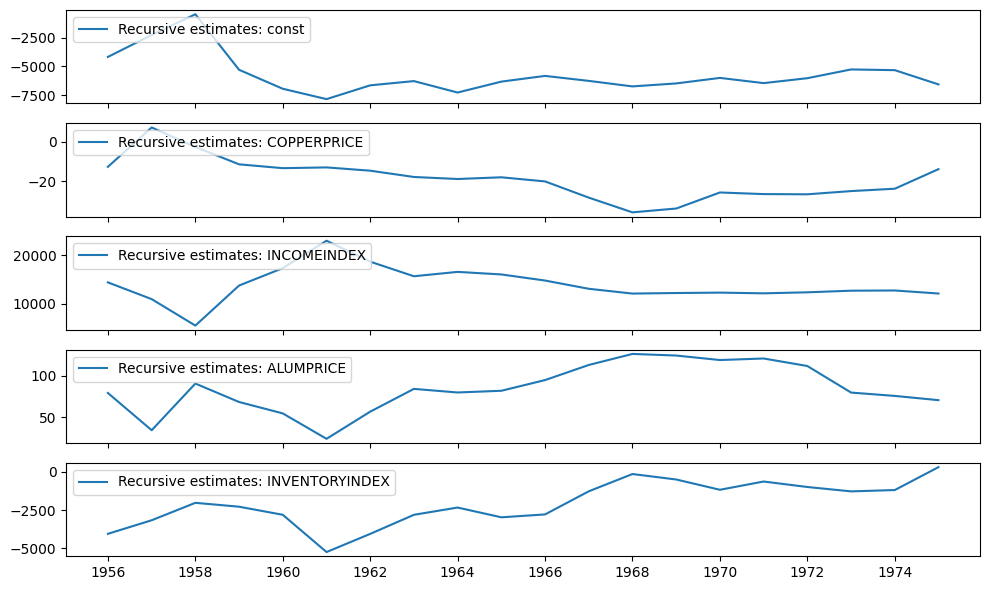

CUSUM 統計量可在 cusum 屬性中取得,但通常使用 plot_cusum 方法視覺檢查參數穩定性更方便。在下面的繪圖中,CUSUM 統計量沒有超出 5% 的顯著性範圍,因此我們無法拒絕參數在 5% 水平上穩定的零假設。

[5]:

print(res.cusum)

fig = res.plot_cusum()

[ 0.69971508 0.65841244 1.24629674 2.05476032 2.39888918 3.1786198

2.67244672 2.01783215 2.46131747 2.05268638 0.95054336 -1.04505546

-2.55465286 -2.29908152 -1.45289492 -1.95353993 -1.3504662 0.15789829

0.6328653 -1.48184586]

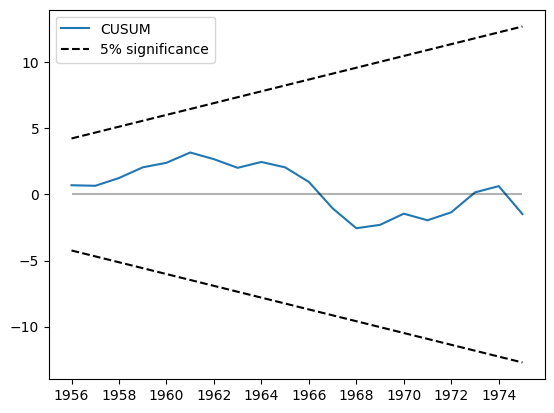

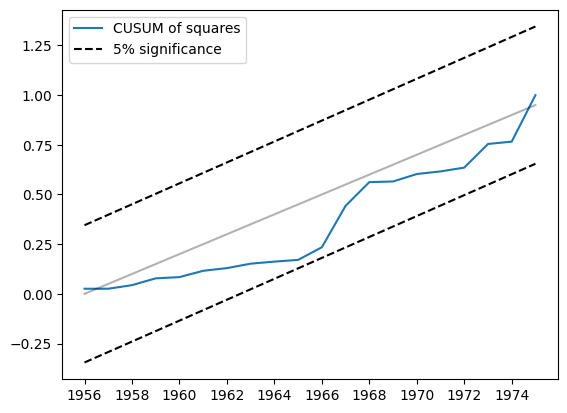

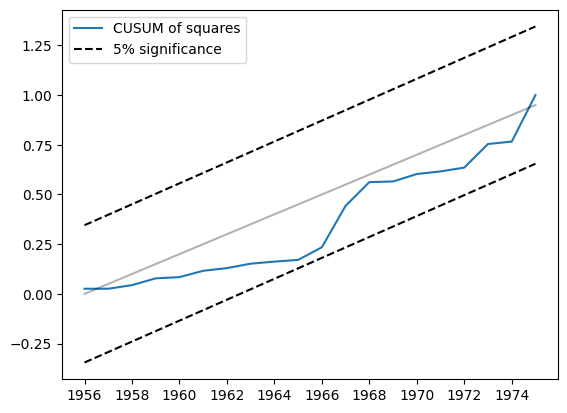

另一個相關的統計量是 CUSUM 平方。它可在 cusum_squares 屬性中取得,但同樣地,使用 plot_cusum_squares 方法視覺檢查更方便。在下面的繪圖中,CUSUM 平方統計量沒有超出 5% 的顯著性範圍,因此我們無法拒絕參數在 5% 水平上穩定的零假設。

[6]:

res.plot_cusum_squares()

[6]:

範例 2:貨幣數量理論¶

貨幣數量理論認為「貨幣數量變化率的既定變化會導致...價格通貨膨脹率的相等變化」(Lucas, 1980)。 繼 Lucas 之後,我們檢視貨幣成長和 CPI 通貨膨脹雙邊指數加權移動平均值之間的關係。 儘管 Lucas 發現這些變數之間的關係是穩定的,但最近這種關係似乎變得不穩定;請參閱例如 Sargent 和 Surico (2010)。

[7]:

start = "1959-12-01"

end = "2015-01-01"

m2 = DataReader("M2SL", "fred", start=start, end=end)

cpi = DataReader("CPIAUCSL", "fred", start=start, end=end)

[8]:

def ewma(series, beta, n_window):

nobs = len(series)

scalar = (1 - beta) / (1 + beta)

ma = []

k = np.arange(n_window, 0, -1)

weights = np.r_[beta ** k, 1, beta ** k[::-1]]

for t in range(n_window, nobs - n_window):

window = series.iloc[t - n_window : t + n_window + 1].values

ma.append(scalar * np.sum(weights * window))

return pd.Series(ma, name=series.name, index=series.iloc[n_window:-n_window].index)

m2_ewma = ewma(np.log(m2["M2SL"].resample("QS").mean()).diff().iloc[1:], 0.95, 10 * 4)

cpi_ewma = ewma(

np.log(cpi["CPIAUCSL"].resample("QS").mean()).diff().iloc[1:], 0.95, 10 * 4

)

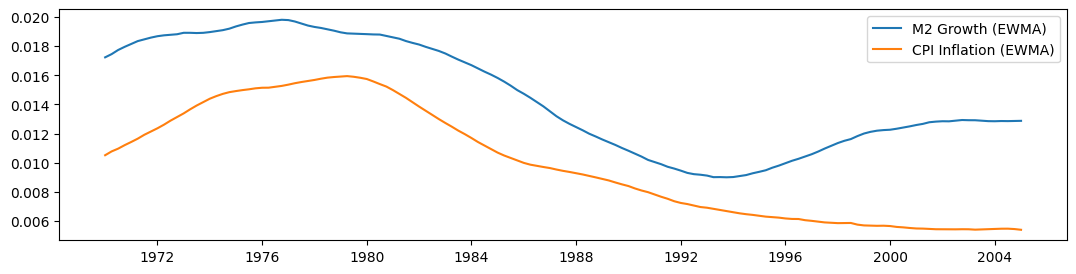

在使用 Lucas 的 \(\beta = 0.95\) 濾波器(兩側視窗為 10 年)構建移動平均值後,我們在下方繪製每個數列。 儘管它們在樣本的一部分之前似乎一起移動,但在 1990 年之後,它們似乎出現分歧。

[9]:

fig, ax = plt.subplots(figsize=(13, 3))

ax.plot(m2_ewma, label="M2 Growth (EWMA)")

ax.plot(cpi_ewma, label="CPI Inflation (EWMA)")

ax.legend()

[9]:

<matplotlib.legend.Legend at 0x7f6e8ca133a0>

[10]:

endog = cpi_ewma

exog = sm.add_constant(m2_ewma)

exog.columns = ["const", "M2"]

mod = sm.RecursiveLS(endog, exog)

res = mod.fit()

print(res.summary())

Statespace Model Results

==============================================================================

Dep. Variable: CPIAUCSL No. Observations: 141

Model: RecursiveLS Log Likelihood 692.878

Date: Thu, 03 Oct 2024 R-squared: 0.813

Time: 15:46:11 AIC -1381.755

Sample: 01-01-1970 BIC -1375.858

- 01-01-2005 HQIC -1379.358

Covariance Type: nonrobust Scale 0.000

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const -0.0034 0.001 -6.013 0.000 -0.004 -0.002

M2 0.9128 0.037 24.601 0.000 0.840 0.986

===================================================================================

Ljung-Box (L1) (Q): 138.23 Jarque-Bera (JB): 18.20

Prob(Q): 0.00 Prob(JB): 0.00

Heteroskedasticity (H): 5.30 Skew: -0.81

Prob(H) (two-sided): 0.00 Kurtosis: 2.27

===================================================================================

Warnings:

[1] Parameters and covariance matrix estimates are RLS estimates conditional on the entire sample.

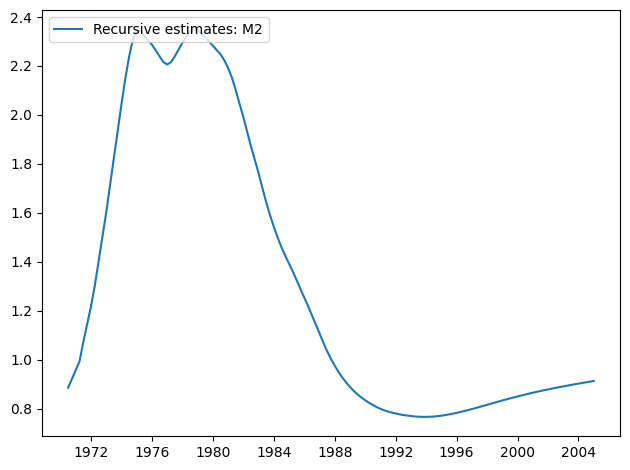

[11]:

res.plot_recursive_coefficient(1, alpha=None)

[11]:

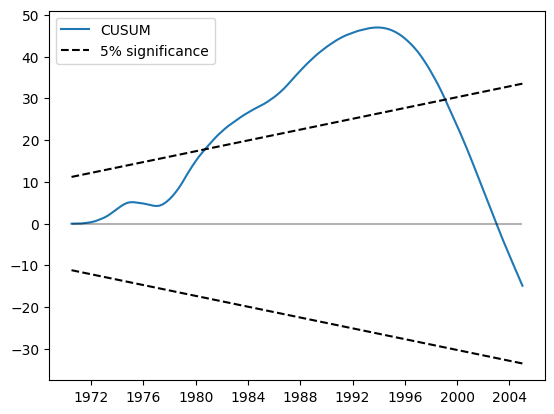

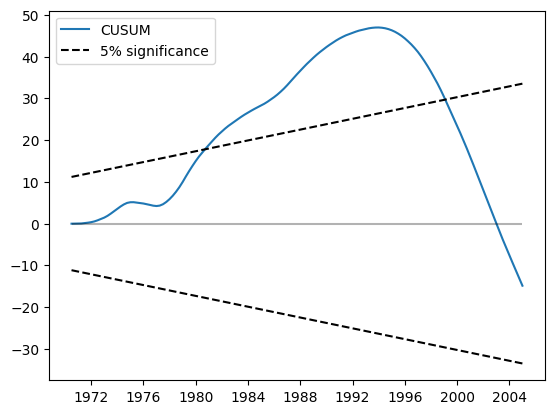

CUSUM 繪圖現在顯示 5% 水平的顯著偏差,表明拒絕參數穩定性的零假設。

[12]:

res.plot_cusum()

[12]:

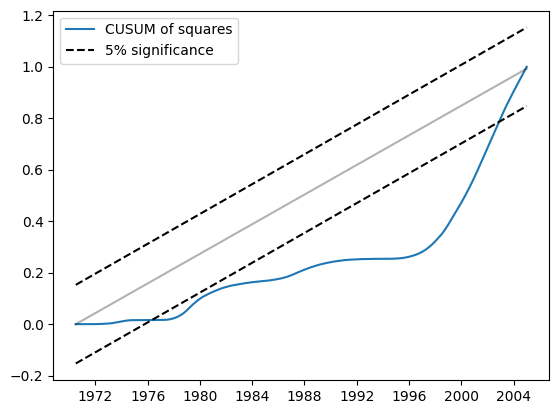

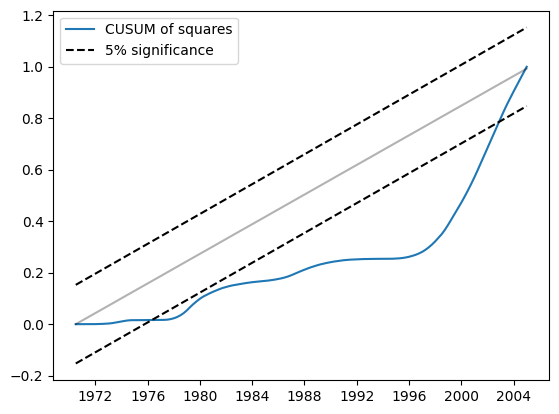

同樣地,CUSUM 平方顯示 5% 水平的顯著偏差,也表明拒絕參數穩定性的零假設。

[13]:

res.plot_cusum_squares()

[13]:

範例 3:線性限制和公式¶

線性限制¶

使用構建模型中的 constraints 參數,不難實現線性限制。

[14]:

endog = dta["WORLDCONSUMPTION"]

exog = sm.add_constant(

dta[["COPPERPRICE", "INCOMEINDEX", "ALUMPRICE", "INVENTORYINDEX"]]

)

mod = sm.RecursiveLS(endog, exog, constraints="COPPERPRICE = ALUMPRICE")

res = mod.fit()

print(res.summary())

Statespace Model Results

==============================================================================

Dep. Variable: WORLDCONSUMPTION No. Observations: 25

Model: RecursiveLS Log Likelihood -134.231

Date: Thu, 03 Oct 2024 R-squared: 0.989

Time: 15:46:14 AIC 276.462

Sample: 01-01-1951 BIC 281.338

- 01-01-1975 HQIC 277.814

Covariance Type: nonrobust Scale 137155.014

==================================================================================

coef std err z P>|z| [0.025 0.975]

----------------------------------------------------------------------------------

const -4839.4836 2412.410 -2.006 0.045 -9567.721 -111.246

COPPERPRICE 5.9797 12.704 0.471 0.638 -18.921 30.880

INCOMEINDEX 1.115e+04 666.308 16.738 0.000 9847.000 1.25e+04

ALUMPRICE 5.9797 12.704 0.471 0.638 -18.921 30.880

INVENTORYINDEX 241.3452 2298.951 0.105 0.916 -4264.515 4747.206

===================================================================================

Ljung-Box (L1) (Q): 6.27 Jarque-Bera (JB): 1.78

Prob(Q): 0.01 Prob(JB): 0.41

Heteroskedasticity (H): 1.75 Skew: -0.63

Prob(H) (two-sided): 0.48 Kurtosis: 2.32

===================================================================================

Warnings:

[1] Parameters and covariance matrix estimates are RLS estimates conditional on the entire sample.

公式¶

可以使用類別方法 from_formula 擬合相同的模型。

[15]:

mod = sm.RecursiveLS.from_formula(

"WORLDCONSUMPTION ~ COPPERPRICE + INCOMEINDEX + ALUMPRICE + INVENTORYINDEX",

dta,

constraints="COPPERPRICE = ALUMPRICE",

)

res = mod.fit()

print(res.summary())

Statespace Model Results

==============================================================================

Dep. Variable: WORLDCONSUMPTION No. Observations: 25

Model: RecursiveLS Log Likelihood -134.231

Date: Thu, 03 Oct 2024 R-squared: 0.989

Time: 15:46:14 AIC 276.462

Sample: 01-01-1951 BIC 281.338

- 01-01-1975 HQIC 277.814

Covariance Type: nonrobust Scale 137155.014

==================================================================================

coef std err z P>|z| [0.025 0.975]

----------------------------------------------------------------------------------

Intercept -4839.4836 2412.410 -2.006 0.045 -9567.721 -111.246

COPPERPRICE 5.9797 12.704 0.471 0.638 -18.921 30.880

INCOMEINDEX 1.115e+04 666.308 16.738 0.000 9847.000 1.25e+04

ALUMPRICE 5.9797 12.704 0.471 0.638 -18.921 30.880

INVENTORYINDEX 241.3452 2298.951 0.105 0.916 -4264.515 4747.206

===================================================================================

Ljung-Box (L1) (Q): 6.27 Jarque-Bera (JB): 1.78

Prob(Q): 0.01 Prob(JB): 0.41

Heteroskedasticity (H): 1.75 Skew: -0.63

Prob(H) (two-sided): 0.48 Kurtosis: 2.32

===================================================================================

Warnings:

[1] Parameters and covariance matrix estimates are RLS estimates conditional on the entire sample.

/opt/hostedtoolcache/Python/3.10.15/x64/lib/python3.10/site-packages/statsmodels/tsa/base/tsa_model.py:473: ValueWarning: No frequency information was provided, so inferred frequency YS-JAN will be used.

self._init_dates(dates, freq)