指數平滑法¶

讓我們考慮 Hyndman 和 Athanasopoulos [1] 所著關於指數平滑法的傑出論文的第 7 章。我們將逐步完成本章中的所有範例。

[1] Hyndman, Rob J., 和 George Athanasopoulos. Forecasting: principles and practice. OTexts, 2014.

載入數據¶

首先,我們載入一些數據。為了方便起見,我們已將 R 數據包含在筆記本中。

[1]:

import os

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from statsmodels.tsa.api import ExponentialSmoothing, SimpleExpSmoothing, Holt

%matplotlib inline

data = [

446.6565,

454.4733,

455.663,

423.6322,

456.2713,

440.5881,

425.3325,

485.1494,

506.0482,

526.792,

514.2689,

494.211,

]

index = pd.date_range(start="1996", end="2008", freq="Y")

oildata = pd.Series(data, index)

data = [

17.5534,

21.86,

23.8866,

26.9293,

26.8885,

28.8314,

30.0751,

30.9535,

30.1857,

31.5797,

32.5776,

33.4774,

39.0216,

41.3864,

41.5966,

]

index = pd.date_range(start="1990", end="2005", freq="Y")

air = pd.Series(data, index)

data = [

263.9177,

268.3072,

260.6626,

266.6394,

277.5158,

283.834,

290.309,

292.4742,

300.8307,

309.2867,

318.3311,

329.3724,

338.884,

339.2441,

328.6006,

314.2554,

314.4597,

321.4138,

329.7893,

346.3852,

352.2979,

348.3705,

417.5629,

417.1236,

417.7495,

412.2339,

411.9468,

394.6971,

401.4993,

408.2705,

414.2428,

]

index = pd.date_range(start="1970", end="2001", freq="Y")

livestock2 = pd.Series(data, index)

data = [407.9979, 403.4608, 413.8249, 428.105, 445.3387, 452.9942, 455.7402]

index = pd.date_range(start="2001", end="2008", freq="Y")

livestock3 = pd.Series(data, index)

data = [

41.7275,

24.0418,

32.3281,

37.3287,

46.2132,

29.3463,

36.4829,

42.9777,

48.9015,

31.1802,

37.7179,

40.4202,

51.2069,

31.8872,

40.9783,

43.7725,

55.5586,

33.8509,

42.0764,

45.6423,

59.7668,

35.1919,

44.3197,

47.9137,

]

index = pd.date_range(start="2005", end="2010-Q4", freq="QS-OCT")

aust = pd.Series(data, index)

/tmp/ipykernel_3946/536270367.py:23: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

index = pd.date_range(start="1996", end="2008", freq="Y")

/tmp/ipykernel_3946/536270367.py:43: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

index = pd.date_range(start="1990", end="2005", freq="Y")

/tmp/ipykernel_3946/536270367.py:79: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

index = pd.date_range(start="1970", end="2001", freq="Y")

/tmp/ipykernel_3946/536270367.py:83: FutureWarning: 'Y' is deprecated and will be removed in a future version, please use 'YE' instead.

index = pd.date_range(start="2001", end="2008", freq="Y")

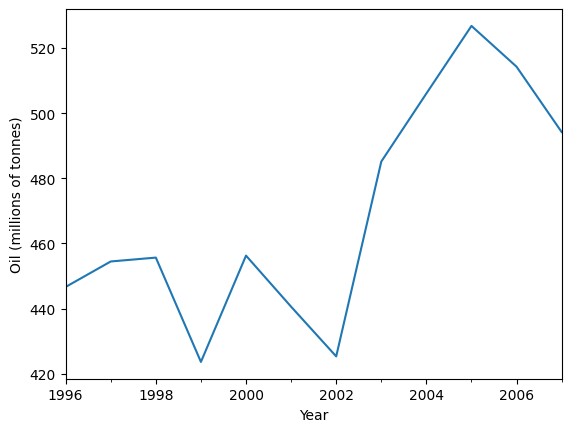

簡單指數平滑法¶

讓我們使用簡單指數平滑法來預測以下石油數據。

[2]:

ax = oildata.plot()

ax.set_xlabel("Year")

ax.set_ylabel("Oil (millions of tonnes)")

print("Figure 7.1: Oil production in Saudi Arabia from 1996 to 2007.")

Figure 7.1: Oil production in Saudi Arabia from 1996 to 2007.

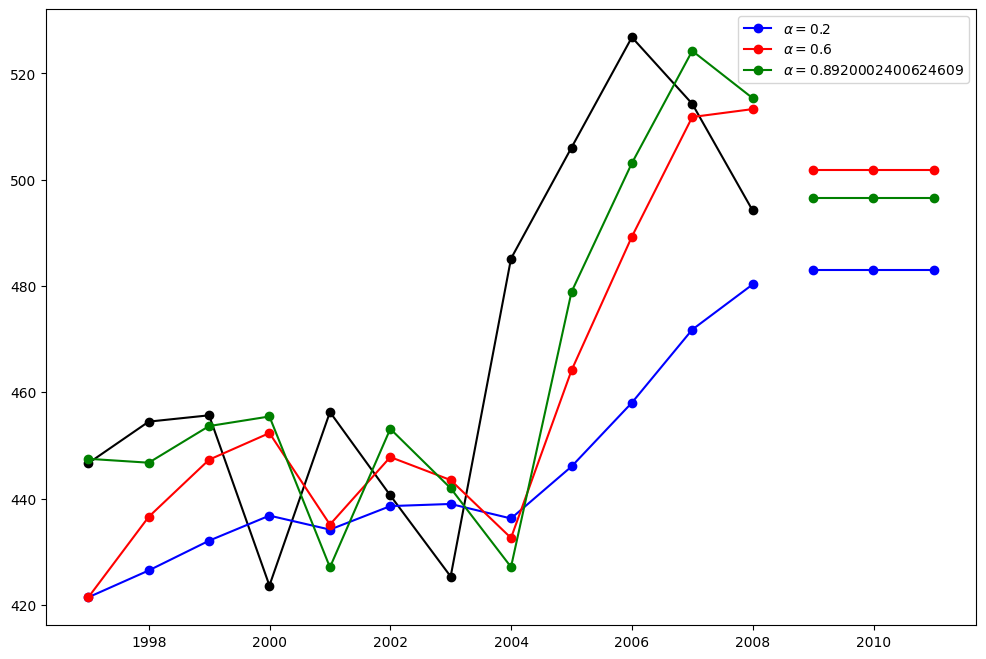

在這裡,我們執行三種簡單指數平滑法的變體:1. 在 fit1 中,我們不使用自動最佳化,而是選擇明確地為模型提供 \(\alpha=0.2\) 參數。2. 在 fit2 中,如上所述,我們選擇 \(\alpha=0.6\)。3. 在 fit3 中,我們允許 statsmodels 自動找到最佳化的 \(\alpha\) 值。這是建議的方法。

[3]:

fit1 = SimpleExpSmoothing(oildata, initialization_method="heuristic").fit(

smoothing_level=0.2, optimized=False

)

fcast1 = fit1.forecast(3).rename(r"$\alpha=0.2$")

fit2 = SimpleExpSmoothing(oildata, initialization_method="heuristic").fit(

smoothing_level=0.6, optimized=False

)

fcast2 = fit2.forecast(3).rename(r"$\alpha=0.6$")

fit3 = SimpleExpSmoothing(oildata, initialization_method="estimated").fit()

fcast3 = fit3.forecast(3).rename(r"$\alpha=%s$" % fit3.model.params["smoothing_level"])

plt.figure(figsize=(12, 8))

plt.plot(oildata, marker="o", color="black")

plt.plot(fit1.fittedvalues, marker="o", color="blue")

(line1,) = plt.plot(fcast1, marker="o", color="blue")

plt.plot(fit2.fittedvalues, marker="o", color="red")

(line2,) = plt.plot(fcast2, marker="o", color="red")

plt.plot(fit3.fittedvalues, marker="o", color="green")

(line3,) = plt.plot(fcast3, marker="o", color="green")

plt.legend([line1, line2, line3], [fcast1.name, fcast2.name, fcast3.name])

[3]:

<matplotlib.legend.Legend at 0x7f4b3edd1930>

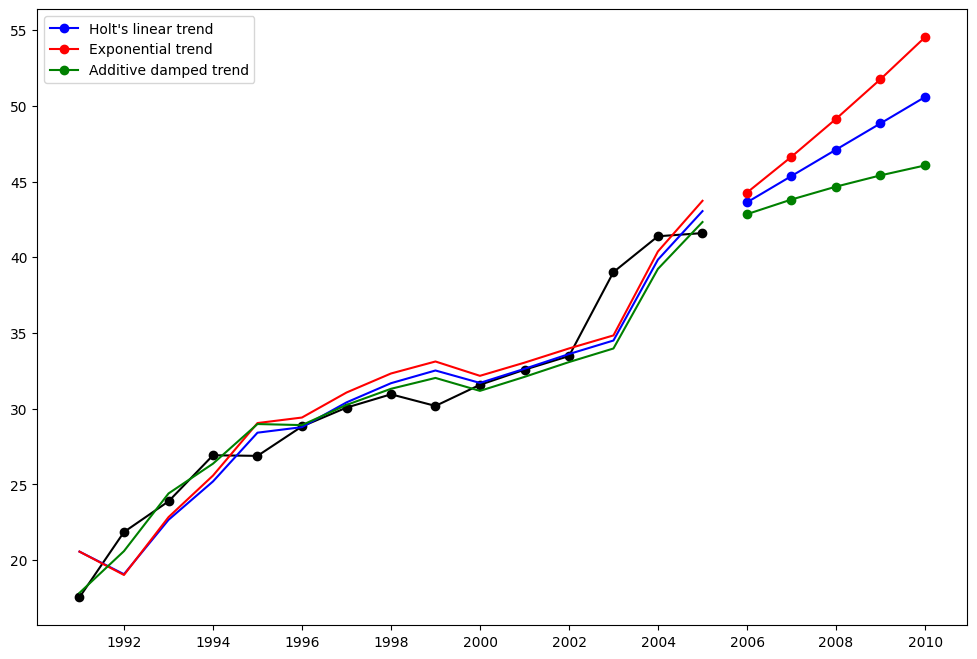

霍爾特方法¶

讓我們看看另一個範例。這次我們使用空氣污染數據和霍爾特方法。我們將再次擬合三個範例。1. 在 fit1 中,我們再次選擇不使用最佳化器,並為 \(\alpha=0.8\) 和 \(\beta=0.2\) 提供明確的值。2. 在 fit2 中,我們與 fit1 中執行相同的操作,但選擇使用指數模型而不是霍爾特的加性模型。3. 在 fit3 中,我們使用了霍爾特加性模型的阻尼版本,但允許阻尼參數 \(\phi\) 在固定 \(\alpha=0.8\) 和 \(\beta=0.2\) 的值時進行最佳化。

[4]:

fit1 = Holt(air, initialization_method="estimated").fit(

smoothing_level=0.8, smoothing_trend=0.2, optimized=False

)

fcast1 = fit1.forecast(5).rename("Holt's linear trend")

fit2 = Holt(air, exponential=True, initialization_method="estimated").fit(

smoothing_level=0.8, smoothing_trend=0.2, optimized=False

)

fcast2 = fit2.forecast(5).rename("Exponential trend")

fit3 = Holt(air, damped_trend=True, initialization_method="estimated").fit(

smoothing_level=0.8, smoothing_trend=0.2

)

fcast3 = fit3.forecast(5).rename("Additive damped trend")

plt.figure(figsize=(12, 8))

plt.plot(air, marker="o", color="black")

plt.plot(fit1.fittedvalues, color="blue")

(line1,) = plt.plot(fcast1, marker="o", color="blue")

plt.plot(fit2.fittedvalues, color="red")

(line2,) = plt.plot(fcast2, marker="o", color="red")

plt.plot(fit3.fittedvalues, color="green")

(line3,) = plt.plot(fcast3, marker="o", color="green")

plt.legend([line1, line2, line3], [fcast1.name, fcast2.name, fcast3.name])

[4]:

<matplotlib.legend.Legend at 0x7f4b3c76be20>

季節性調整數據¶

讓我們看看一些季節性調整的牲畜數據。我們擬合五個霍爾特模型。當我們使用指數與加性以及阻尼與非阻尼時,下表允許我們比較結果。

注意:fit4 不允許通過提供 \(\phi=0.98\) 的固定值來最佳化參數 \(\phi\)。

[5]:

fit1 = SimpleExpSmoothing(livestock2, initialization_method="estimated").fit()

fit2 = Holt(livestock2, initialization_method="estimated").fit()

fit3 = Holt(livestock2, exponential=True, initialization_method="estimated").fit()

fit4 = Holt(livestock2, damped_trend=True, initialization_method="estimated").fit(

damping_trend=0.98

)

fit5 = Holt(

livestock2, exponential=True, damped_trend=True, initialization_method="estimated"

).fit()

params = [

"smoothing_level",

"smoothing_trend",

"damping_trend",

"initial_level",

"initial_trend",

]

results = pd.DataFrame(

index=[r"$\alpha$", r"$\beta$", r"$\phi$", r"$l_0$", "$b_0$", "SSE"],

columns=["SES", "Holt's", "Exponential", "Additive", "Multiplicative"],

)

results["SES"] = [fit1.params[p] for p in params] + [fit1.sse]

results["Holt's"] = [fit2.params[p] for p in params] + [fit2.sse]

results["Exponential"] = [fit3.params[p] for p in params] + [fit3.sse]

results["Additive"] = [fit4.params[p] for p in params] + [fit4.sse]

results["Multiplicative"] = [fit5.params[p] for p in params] + [fit5.sse]

results

[5]:

| SES | 霍爾特 | 指數 | 加性 | 乘法 | |

|---|---|---|---|---|---|

| $\alpha$ | 1.000000 | 0.974338 | 0.977642 | 0.978843 | 0.974912 |

| $\beta$ | NaN | 0.000000 | 0.000000 | 0.000008 | 0.000000 |

| $\phi$ | NaN | NaN | NaN | 0.980000 | 0.981646 |

| $l_0$ | 263.917703 | 258.882683 | 260.335599 | 257.357716 | 258.951817 |

| $b_0$ | NaN | 5.010856 | 1.013780 | 6.645297 | 1.038144 |

| SSE | 6761.350235 | 6004.138207 | 6104.194782 | 6036.597169 | 6081.995045 |

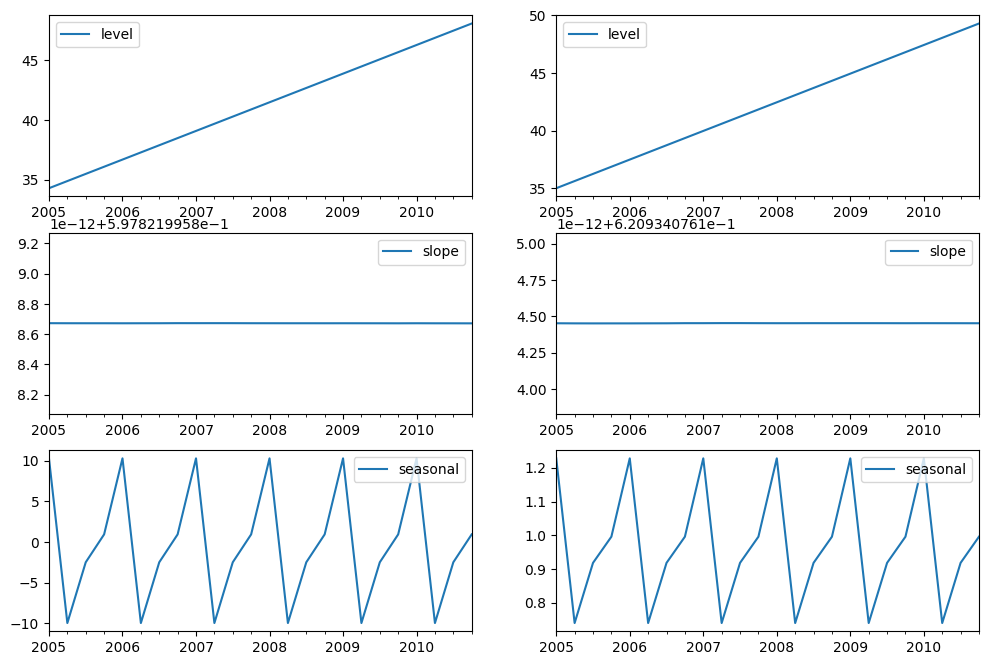

季節性調整數據圖¶

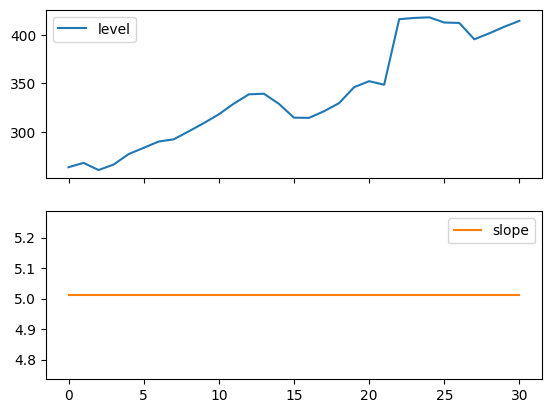

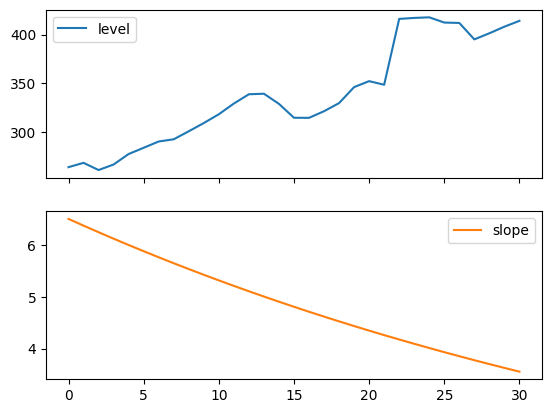

以下圖允許我們評估上表中擬合的層級和斜率/趨勢分量。

[6]:

for fit in [fit2, fit4]:

pd.DataFrame(np.c_[fit.level, fit.trend]).rename(

columns={0: "level", 1: "slope"}

).plot(subplots=True)

plt.show()

print(

"Figure 7.4: Level and slope components for Holt’s linear trend method and the additive damped trend method."

)

Figure 7.4: Level and slope components for Holt’s linear trend method and the additive damped trend method.

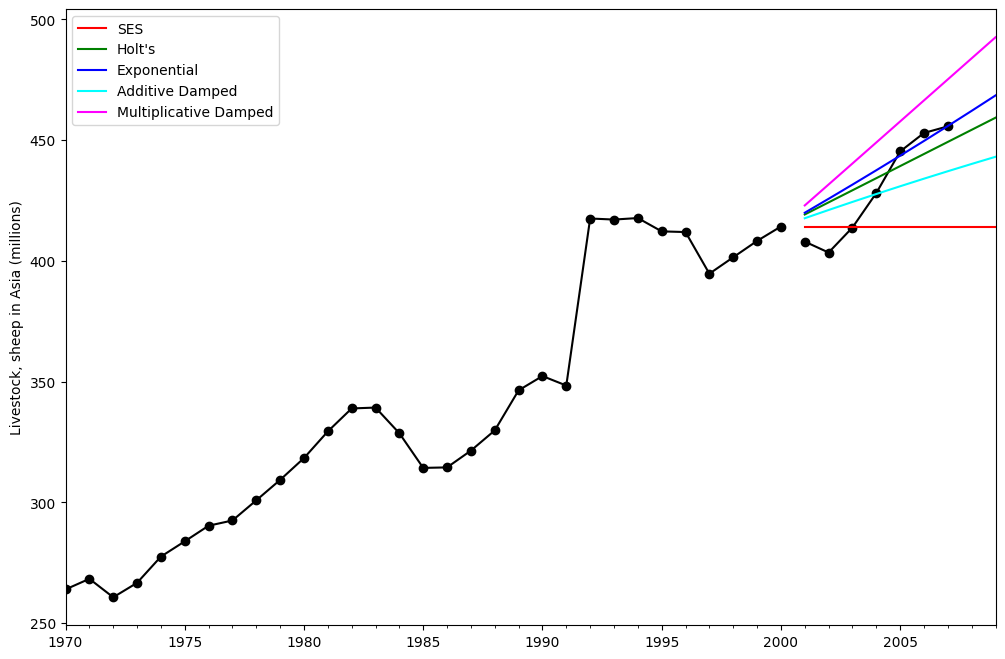

比較¶

在這裡,我們繪製一個比較簡單指數平滑法和霍爾特方法在各種加性、指數和阻尼組合下的比較圖。所有模型的參數都將由 statsmodels 進行最佳化。

[7]:

fit1 = SimpleExpSmoothing(livestock2, initialization_method="estimated").fit()

fcast1 = fit1.forecast(9).rename("SES")

fit2 = Holt(livestock2, initialization_method="estimated").fit()

fcast2 = fit2.forecast(9).rename("Holt's")

fit3 = Holt(livestock2, exponential=True, initialization_method="estimated").fit()

fcast3 = fit3.forecast(9).rename("Exponential")

fit4 = Holt(livestock2, damped_trend=True, initialization_method="estimated").fit(

damping_trend=0.98

)

fcast4 = fit4.forecast(9).rename("Additive Damped")

fit5 = Holt(

livestock2, exponential=True, damped_trend=True, initialization_method="estimated"

).fit()

fcast5 = fit5.forecast(9).rename("Multiplicative Damped")

ax = livestock2.plot(color="black", marker="o", figsize=(12, 8))

livestock3.plot(ax=ax, color="black", marker="o", legend=False)

fcast1.plot(ax=ax, color="red", legend=True)

fcast2.plot(ax=ax, color="green", legend=True)

fcast3.plot(ax=ax, color="blue", legend=True)

fcast4.plot(ax=ax, color="cyan", legend=True)

fcast5.plot(ax=ax, color="magenta", legend=True)

ax.set_ylabel("Livestock, sheep in Asia (millions)")

plt.show()

print(

"Figure 7.5: Forecasting livestock, sheep in Asia: comparing forecasting performance of non-seasonal methods."

)

Figure 7.5: Forecasting livestock, sheep in Asia: comparing forecasting performance of non-seasonal methods.

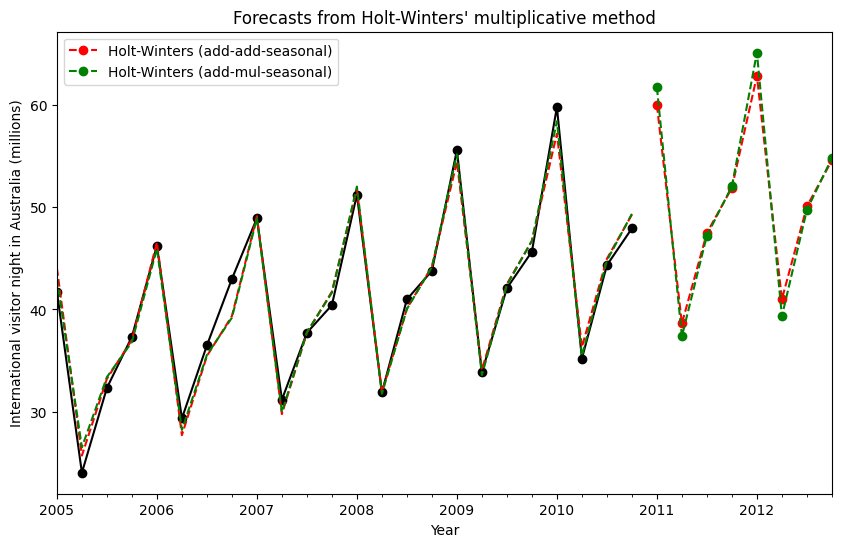

霍爾特-溫特季節性模型¶

最後,我們能夠執行完整的霍爾特-溫特季節性指數平滑法,包括趨勢分量和季節性分量。statsmodels 允許所有組合,包括以下範例中所示的組合:1. fit1 加性趨勢、週期為 season_length=4 的加性季節性,以及 Box-Cox 轉換的使用。2. fit2 加性趨勢、週期為 season_length=4 的乘法季節性,以及 Box-Cox 轉換的使用。3. fit3 加性阻尼趨勢、週期為 season_length=4 的加性季節性,以及 Box-Cox 轉換的使用。4. fit4 加性阻尼趨勢、週期為 season_length=4 的乘法季節性,以及 Box-Cox 轉換的使用。

該圖顯示了 fit1 和 fit2 的結果和預測。該表允許我們比較結果和參數化。

[8]:

fit1 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="add",

use_boxcox=True,

initialization_method="estimated",

).fit()

fit2 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

use_boxcox=True,

initialization_method="estimated",

).fit()

fit3 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="add",

damped_trend=True,

use_boxcox=True,

initialization_method="estimated",

).fit()

fit4 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

damped_trend=True,

use_boxcox=True,

initialization_method="estimated",

).fit()

results = pd.DataFrame(

index=[r"$\alpha$", r"$\beta$", r"$\phi$", r"$\gamma$", r"$l_0$", "$b_0$", "SSE"]

)

params = [

"smoothing_level",

"smoothing_trend",

"damping_trend",

"smoothing_seasonal",

"initial_level",

"initial_trend",

]

results["Additive"] = [fit1.params[p] for p in params] + [fit1.sse]

results["Multiplicative"] = [fit2.params[p] for p in params] + [fit2.sse]

results["Additive Dam"] = [fit3.params[p] for p in params] + [fit3.sse]

results["Multiplica Dam"] = [fit4.params[p] for p in params] + [fit4.sse]

ax = aust.plot(

figsize=(10, 6),

marker="o",

color="black",

title="Forecasts from Holt-Winters' multiplicative method",

)

ax.set_ylabel("International visitor night in Australia (millions)")

ax.set_xlabel("Year")

fit1.fittedvalues.plot(ax=ax, style="--", color="red")

fit2.fittedvalues.plot(ax=ax, style="--", color="green")

fit1.forecast(8).rename("Holt-Winters (add-add-seasonal)").plot(

ax=ax, style="--", marker="o", color="red", legend=True

)

fit2.forecast(8).rename("Holt-Winters (add-mul-seasonal)").plot(

ax=ax, style="--", marker="o", color="green", legend=True

)

plt.show()

print(

"Figure 7.6: Forecasting international visitor nights in Australia using Holt-Winters method with both additive and multiplicative seasonality."

)

results

Figure 7.6: Forecasting international visitor nights in Australia using Holt-Winters method with both additive and multiplicative seasonality.

[8]:

| 加性 | 乘法 | 加性阻尼 | 乘法阻尼 | |

|---|---|---|---|---|

| $\alpha$ | 1.490116e-08 | 1.490116e-08 | 1.490116e-08 | 1.490116e-08 |

| $\beta$ | 1.409865e-08 | 0.000000e+00 | 6.490845e-09 | 5.042120e-09 |

| $\phi$ | NaN | NaN | 9.430416e-01 | 9.536043e-01 |

| $\gamma$ | 7.066690e-16 | 1.514304e-16 | 1.169213e-15 | 0.000000e+00 |

| $l_0$ | 1.119348e+01 | 1.106382e+01 | 1.084022e+01 | 9.899305e+00 |

| $b_0$ | 1.205396e-01 | 1.198963e-01 | 2.456750e-01 | 1.975449e-01 |

| SSE | 4.402746e+01 | 3.611262e+01 | 3.527620e+01 | 3.062033e+01 |

內部機制¶

可以獲取指數平滑模型 的內部機制。

在這裡,我們展示一些表格,讓您可以並排查看原始值 \(y_t\)、層級 \(l_t\)、趨勢 \(b_t\)、季節性 \(s_t\) 和擬合值 \(\hat{y}_t\)。請注意,如果擬合是在沒有 Box-Cox 轉換的情況下執行的,則這些值僅在原始數據空間中具有有意義的值。

[9]:

fit1 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="add",

initialization_method="estimated",

).fit()

fit2 = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

initialization_method="estimated",

).fit()

[10]:

df = pd.DataFrame(

np.c_[aust, fit1.level, fit1.trend, fit1.season, fit1.fittedvalues],

columns=[r"$y_t$", r"$l_t$", r"$b_t$", r"$s_t$", r"$\hat{y}_t$"],

index=aust.index,

)

forecasts = fit1.forecast(8).rename(r"$\hat{y}_t$").to_frame()

df = pd.concat([df, forecasts], axis=0, sort=True)

[11]:

df = pd.DataFrame(

np.c_[aust, fit2.level, fit2.trend, fit2.season, fit2.fittedvalues],

columns=[r"$y_t$", r"$l_t$", r"$b_t$", r"$s_t$", r"$\hat{y}_t$"],

index=aust.index,

)

forecasts = fit2.forecast(8).rename(r"$\hat{y}_t$").to_frame()

df = pd.concat([df, forecasts], axis=0, sort=True)

最後,讓我們看看模型的層級、斜率/趨勢和季節性分量。

[12]:

states1 = pd.DataFrame(

np.c_[fit1.level, fit1.trend, fit1.season],

columns=["level", "slope", "seasonal"],

index=aust.index,

)

states2 = pd.DataFrame(

np.c_[fit2.level, fit2.trend, fit2.season],

columns=["level", "slope", "seasonal"],

index=aust.index,

)

fig, [[ax1, ax4], [ax2, ax5], [ax3, ax6]] = plt.subplots(3, 2, figsize=(12, 8))

states1[["level"]].plot(ax=ax1)

states1[["slope"]].plot(ax=ax2)

states1[["seasonal"]].plot(ax=ax3)

states2[["level"]].plot(ax=ax4)

states2[["slope"]].plot(ax=ax5)

states2[["seasonal"]].plot(ax=ax6)

plt.show()

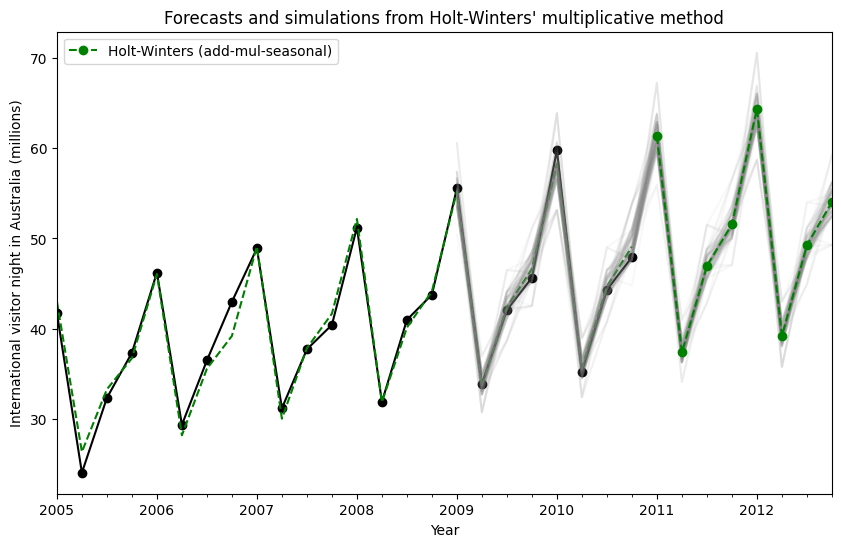

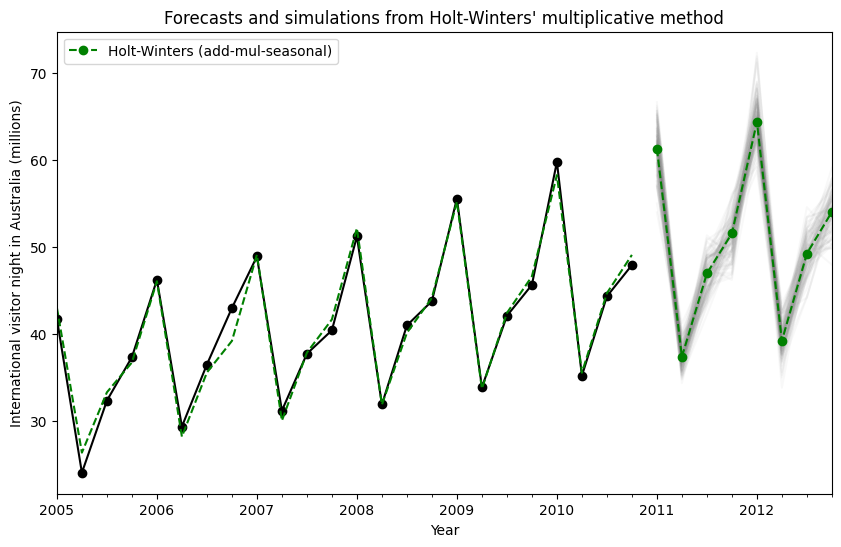

模擬和信賴區間¶

通過使用狀態空間公式,我們可以執行未來值的模擬。數學細節在 Hyndman 和 Athanasopoulos [2] 以及 HoltWintersResults.simulate 的文件中進行了描述。

與 [2] 中的範例類似,我們使用具有加性趨勢、乘法季節性和乘法誤差的模型。我們模擬未來最多 8 個步驟,並執行 1000 次模擬。如下圖所示,模擬與預測值非常吻合。

[13]:

fit = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

initialization_method="estimated",

).fit()

simulations = fit.simulate(8, repetitions=100, error="mul")

ax = aust.plot(

figsize=(10, 6),

marker="o",

color="black",

title="Forecasts and simulations from Holt-Winters' multiplicative method",

)

ax.set_ylabel("International visitor night in Australia (millions)")

ax.set_xlabel("Year")

fit.fittedvalues.plot(ax=ax, style="--", color="green")

simulations.plot(ax=ax, style="-", alpha=0.05, color="grey", legend=False)

fit.forecast(8).rename("Holt-Winters (add-mul-seasonal)").plot(

ax=ax, style="--", marker="o", color="green", legend=True

)

plt.show()

模擬也可以在不同的時間點開始,並且有多種選項可選擇隨機雜訊。

[14]:

fit = ExponentialSmoothing(

aust,

seasonal_periods=4,

trend="add",

seasonal="mul",

initialization_method="estimated",

).fit()

simulations = fit.simulate(

16, anchor="2009-01-01", repetitions=100, error="mul", random_errors="bootstrap"

)

ax = aust.plot(

figsize=(10, 6),

marker="o",

color="black",

title="Forecasts and simulations from Holt-Winters' multiplicative method",

)

ax.set_ylabel("International visitor night in Australia (millions)")

ax.set_xlabel("Year")

fit.fittedvalues.plot(ax=ax, style="--", color="green")

simulations.plot(ax=ax, style="-", alpha=0.05, color="grey", legend=False)

fit.forecast(8).rename("Holt-Winters (add-mul-seasonal)").plot(

ax=ax, style="--", marker="o", color="green", legend=True

)

plt.show()